Funding the Future: Navigating Commercial Construction Financing

Have you ever watched a commercial building take shape and wondered how it all gets funded? Behind every rising steel beam and concrete pour is a carefully structured financial plan. Commercial construction financing is the engine that powers these projects from blueprint to grand opening.

At its core, commercial construction financing refers to specialized loans designed specifically for building or renovating commercial properties. Unlike the mortgage you might have on your home, these loans deliver funding in phases as your project progresses.

The construction industry is a powerhouse of the American economy. With private construction spending approaching a staggering $975 billion last year and more than 7 million people employed in the field, getting your financing right isn’t just important—it’s essential for success.

What makes these loans unique? Think of commercial construction financing as more like a financial partner than just a lump sum of money. Your loan works almost like a line of credit—you only pay interest on the funds you’ve actually drawn during construction. This clever structure helps protect your cash flow during the building phase when your property isn’t yet generating income.

As one industry expert puts it: “A construction loan can be complex, but with the right lender, the process becomes drastically simplified.”

The beauty (and complexity) of commercial construction financing lies in its staged approach. Funds are released through “draws” as your construction hits specific milestones. This isn’t just red tape—it protects both you and the lender by ensuring money flows exactly when and where it’s needed based on actual progress.

Most lenders will finance between 70-90% of your total project costs, which means you’ll need to bring some skin in the game with a down payment covering the remainder. This equity requirement helps lenders feel comfortable with what they consider one of their higher-risk lending categories.

Here’s what you can typically expect with different financing options:

| Type | Down Payment | Typical Rate | Term Length |

|---|---|---|---|

| Bank Loans | 20-25% | 4-12% | 12-36 months |

| SBA 504/7(a) | 10-15% | Prime + 0-2.75% | Up to 25 years |

| Hard Money | 25-40% | 10-15% | 6-24 months |

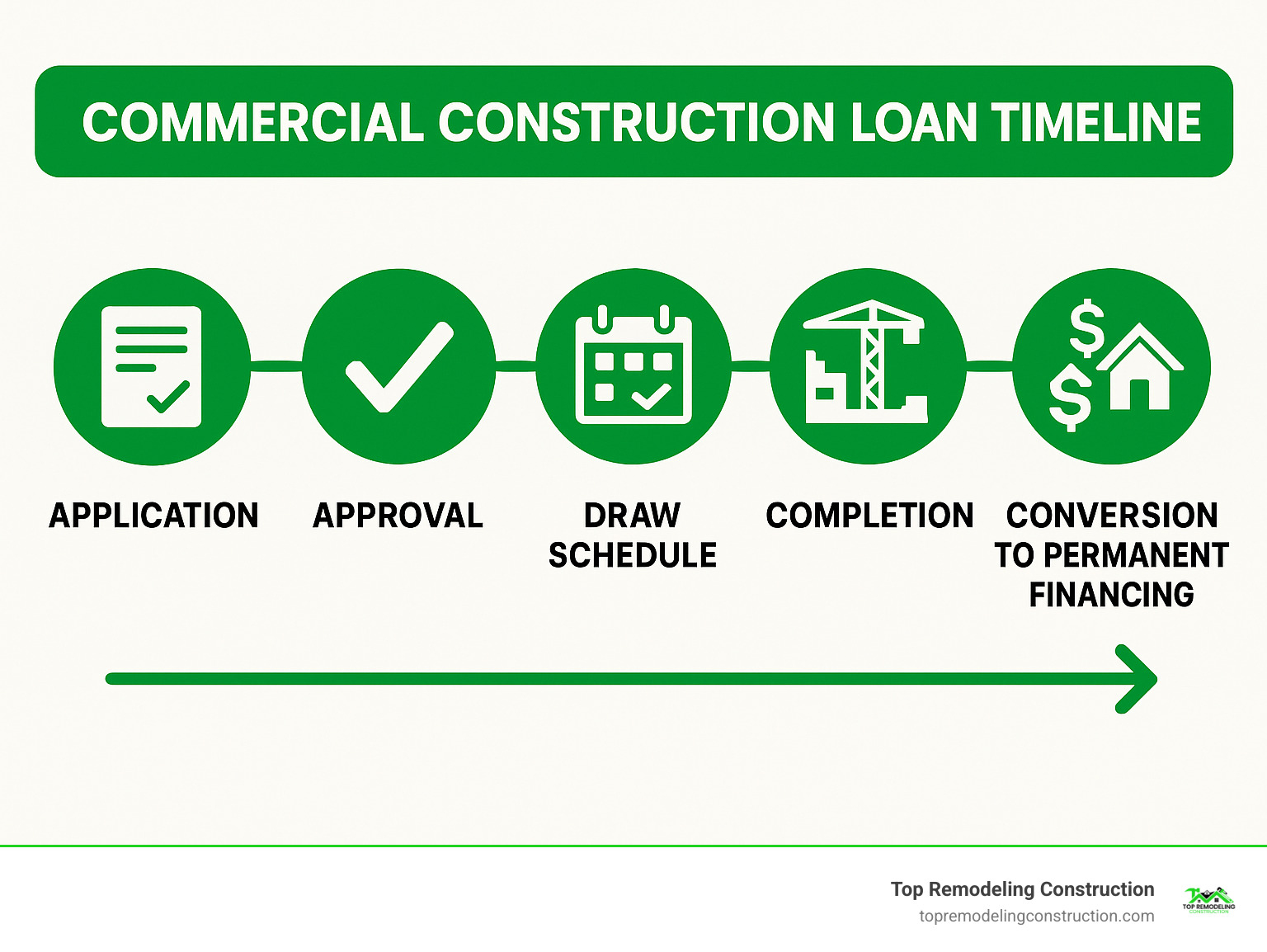

Understanding the timeline of your financing is just as important as the numbers. From application to final conversion, knowing what to expect helps you plan effectively.

At Top Remodeling Construction, we’ve guided countless clients through this financing journey. While we’re experts in building, we’ve seen how the right financing approach can make or break a project’s success. The construction may be temporary, but the financial decisions you make will impact your investment for years to come.

Understanding Commercial Construction Financing

Building a commercial property is exciting, but figuring out how to pay for it can feel overwhelming. That’s where commercial construction financing comes in – it’s not just a loan, but your blueprint for bringing commercial dreams to life.

Unlike your home mortgage, commercial construction financing is designed specifically for bigger projects with unique challenges and timelines. Think of it as a specialized financial tool built for business construction needs.

Your commercial construction financing can fund a wide variety of projects – from sleek office buildings and busy retail centers to welcoming hotels, modern medical facilities, and practical warehouses. We’ve helped clients finance everything from multi-family apartment complexes to mixed-use developments that combine retail and residential spaces.

These loans cover both the obvious “hard costs” (the materials and labor that physically create your building) and the less visible but equally important “soft costs” (those architectural fees, permits, and surveys that make everything legal and proper). Many loans also include land acquisition, though some lenders prefer handling land purchases separately.

The stakes in commercial construction are substantial – and sometimes challenging. Across North America, the average construction payment dispute reaches a whopping $18.8 million and takes nearly 18 months to resolve. This highlights why proper financing and clear agreements matter so much from day one.

What Is a Commercial Construction Loan?

A commercial construction loan is essentially a short-term financial partnership designed specifically for building or substantially renovating income-producing properties. These loans typically run 12 to 36 months – just long enough to get your project built and ready for business.

The heart of commercial construction financing is the draw schedule. Instead of getting all your money upfront (imagine the temptation!), funds are released in phases as you reach and verify construction milestones. It’s like having a financial roadmap that matches your construction timeline – reducing risk for lenders while helping you manage your project more effectively.

Most of these loans are structured with interest-only payments during construction. This is actually a helpful feature – you’ll only pay interest on funds you’ve actually drawn, not on the total approved amount. For example, if you secure a $1 million construction loan but have only drawn $200,000 so far, you’re only paying interest on that $200,000.

Typically, lenders will finance between 70% to 90% of your total project cost (that’s your loan-to-cost ratio), with you contributing the remainder as equity.

“When structuring a commercial construction loan, we always recommend clients build in a 10% contingency reserve,” explains one of our project managers at Top Remodeling Construction. “In Las Vegas, where material deliveries can be affected by various factors, having this buffer has saved numerous projects from costly delays.”

Commercial Construction Financing vs. Traditional Mortgage

Understanding the differences between construction loans and traditional mortgages will save you headaches down the road. They’re different animals designed for different purposes.

While a traditional mortgage is a long-term commitment on an existing property, commercial construction financing is more like a short-term partnership focused on the building process itself. Your construction loan is secured by both the land and whatever portion of the structure exists at any given point – which naturally presents higher risk to lenders than a fully-built property.

Interest rates for construction loans typically float with market indexes like SOFR or Prime, plus a margin. This variable nature differs from traditional mortgages, which often lock in fixed rates for decades. Your construction loan will release funds gradually according to that all-important draw schedule, rather than giving you everything at closing.

During construction, you’ll usually make interest-only payments on the funds you’ve used – a helpful feature when you’re managing cash flow before your property starts generating income. Once construction wraps up, many loans offer a conversion option to permanent financing when your property achieves stabilization (typically reaching certain occupancy levels and demonstrating positive cash flow).

At Top Remodeling Construction, we’ve guided many clients through this financing journey. The process might seem complex at first, but with the right partner, you can steer it confidently – turning blueprints into buildings that serve your business goals for years to come.

Mechanics: From Draw Schedules to Permanent Loans

The mechanics of commercial construction financing might sound complicated, but they’re really just a well-choreographed dance between you, your lender, and your construction team. Understanding how money flows throughout your project is crucial for keeping your build on track and your relationships with lenders positive.

The Draw/Disbursement Process in Commercial Construction Financing

Think of the draw schedule as your project’s financial heartbeat. Instead of getting all your loan money upfront, funds are released in stages as you hit specific milestones in your construction journey. This approach protects both you and your lender while ensuring money is available when you need it.

Your construction milestones typically follow the natural building sequence – starting with foundation work, moving through framing, roofing, mechanical systems, and finishing with the final touches. Before releasing each payment, your lender will want to verify progress with their own eyes.

“When I explain the payment distribution process to our Las Vegas clients,” says our finance coordinator at Top Remodeling Construction, “I tell them to think of it as a trust-building exercise with their lender. Show progress, get paid, repeat.”

Before each disbursement hits your account, you’ll need to provide some paperwork. Your lender will typically request an inspection report, updated title information to check for any new liens, signed lien waivers from your contractors and suppliers, and documentation showing you’re staying on budget.

Most lenders also hold back a small portion (usually 5-10%) of each payment as “retainage” – a financial safety net that’s released when everything is complete and all documentation is finalized. It’s like a little forced savings plan that protects everyone involved.

One helpful feature of many commercial construction financing packages is the interest reserve. This clever tool sets aside part of your loan specifically for making interest payments during construction, so you’re not reaching into your pocket for monthly payments while your building is still taking shape.

Construction-to-Permanent Loans: One-Time Close Advantage

If you’re looking to simplify your financing journey, construction-to-permanent loans (or “C-to-P” loans) offer a compelling “one-and-done” approach. Instead of securing separate loans for construction and long-term ownership, these combination products handle everything in a single package.

The beauty of this approach is in its simplicity. You’ll enjoy just one application process, one approval, one closing, and one set of closing costs. Many of these loans even let you lock in your permanent financing rate from the beginning, giving you peace of mind in fluctuating markets.

During construction, you’ll typically make interest-only payments on the funds you’ve used so far. Then, once your building is complete, the loan automatically converts to a traditional mortgage with regular principal-and-interest payments, usually with a term of 15-30 years.

This structure is particularly helpful for owner-occupied properties. When you’re building a space for your own business, the last thing you need is financial complexity while you’re trying to get operations up and running. The smoother transition means one less thing to worry about during an already busy time.

At Top Remodeling Construction, we’ve guided countless clients through this process, helping them understand each step so they can focus on what matters most: seeing their construction vision become reality.

Financing Options Explained

The commercial construction financing landscape offers various options to match different project needs, timelines, and borrower qualifications. Understanding the full spectrum of available financing vehicles can help you structure the optimal funding strategy for your specific project.

SBA 504 & 7(a): High Leverage, Low Down

Small Business Administration (SBA) loans represent some of the most attractive financing options for owner-occupied commercial construction projects. The two primary programs are:

SBA 504 Loans:

– Designed specifically for owner-occupied commercial real estate and equipment

– Typically structured as:

– 10% borrower down payment

– 40% SBA-backed CDC (Certified Development Company) loan

– 50% conventional bank loan

– Benefits include:

– Up to 90% financing (only 10% down)

– Below-market, fixed interest rates on the CDC portion

– Long-term financing (10, 20, or 25 years)

– Can finance projects up to $5 million (or more in certain cases)

SBA 7(a) Loans:

– The SBA’s primary and most flexible loan program

– Can be used for construction, acquisition, renovation, and working capital

– Provides up to 90% financing in some cases

– Offers terms up to 25 years for real estate

– Interest rates typically range from Prime + 0% to Prime + 2.75%

– Loan guarantee reduces lender risk, making approval more likely

“SBA loans are particularly valuable for small to mid-sized businesses looking to construct their own facilities,” explains our project consultant. “In Las Vegas, we’ve seen numerous businesses leverage these programs to build custom facilities with minimal cash outlay.”

The primary requirement for SBA construction loans is that the property must be at least 51% owner-occupied for existing buildings or 60% for new construction.

Hard Money & Private Capital

When conventional or SBA financing isn’t available or time is of the essence, hard money loans and private capital can provide alternative funding sources for commercial construction projects.

Hard Money Loans:

– Asset-based lending focused primarily on the property value

– Typically fund 65-80% of project costs

– Higher interest rates (10-15% or more)

– Shorter terms (usually 6-24 months)

– Faster approval and funding (sometimes within days)

– Less emphasis on borrower credit and more on the project itself

– Often used for projects with timeline constraints or credit challenges

Private Equity Partnerships:

– Investors provide capital in exchange for ownership stake

– Can fund up to 100% of project costs in some cases

– Requires profit-sharing or preferred returns

– May involve giving up some control of the project

– Often combines with debt financing in a capital stack approach

Hard money loans and private capital are particularly useful for:

– Borrowers with credit challenges

– Time-sensitive opportunities

– Projects that don’t fit conventional lending criteria

– Experienced developers with strong track records but temporary financial constraints

Alternative Paths Beyond Commercial Construction Financing

Beyond traditional commercial construction financing, several alternative funding mechanisms can supplement or replace conventional loans:

Business Lines of Credit:

– Flexible funding that can be drawn as needed

– Can cover cost overruns or unexpected expenses

– Often used to bridge timing gaps in draw schedules

– May have lower interest rates than construction loans

Equipment Financing:

– Specific to construction equipment purchases

– The equipment itself serves as collateral

– Terms typically match the useful life of the equipment

– Can preserve cash for other construction expenses

Invoice Factoring:

– Converts outstanding invoices into immediate cash

– Useful for contractors managing cash flow while awaiting payment

– Typically advances 80% of invoice value upfront

– Remaining amount (minus fees) paid when client pays the invoice

Crowdfunding:

– Raises capital from multiple small investors

– Can be structured as debt, equity, or rewards-based

– Online platforms streamline the process

– May include marketing benefits beyond just financing

“We’ve seen creative combinations of these funding sources work well for our clients,” notes our financial advisor at Top Remodeling Construction. “For instance, one Las Vegas client combined a traditional construction loan with equipment financing and a business line of credit to optimize their capital structure and maintain flexibility.”

Qualifying, Terms, and Application Checklist

Qualifying for commercial construction financing requires thorough preparation and a clear understanding of lender expectations. The application process is typically more rigorous than for other types of commercial loans due to the inherent risks in construction projects.

Typical Terms, Rates & Fees for Commercial Construction Financing

When we sit down with our Las Vegas clients to discuss financing options, we often start by explaining what they can expect in terms of loan structure. Most construction loans have a lifespan of 12-36 months for construction-only options, though construction-to-permanent loans can extend up to 25 years after conversion.

During the construction phase, you’ll typically only pay interest on the funds you’ve actually drawn – a helpful feature for managing cash flow when you’re juggling contractor payments and material costs. The interest accrues monthly, with rates that tend to float with market indexes like SOFR or Prime.

Speaking of rates, they vary widely based on your risk profile and the lender’s assessment of your project. Conventional loans generally range from 4-15%, with spreads of 2-5% above the base rate. If you’re considering hard money loans (which sometimes make sense for specific situations), expect to pay a premium – usually 10-15% or higher. SBA loans, on the other hand, often offer more favorable rates.

As for fees, prepare for origination charges between 1-3% of your loan amount. If you’re going the SBA route, you’ll have guarantee fees, though these can usually be financed into the loan. Other common expenses include appraisals ($2,000-$10,000), regular inspections ($500-$1,000 each), and title updates with each draw ($200-$500).

Down payment requirements vary by loan type – conventional lenders typically want 20-30% down, SBA loans might accept 10-15%, while hard money lenders often require 25-40%. Most lenders will also insist on a contingency reserve of 5-10% to cover those inevitable surprises that pop up during construction.

Eligibility Requirements & Required Documentation

“Getting your paperwork in order early can save weeks of delays,” our project manager often tells clients. Lenders want to see that both you and your project are solid investments.

For the borrower, most conventional lenders look for a credit score of at least 650, though higher scores will secure better terms. Your project should demonstrate a Debt Service Coverage Ratio of at least 1.25, meaning the property will generate 25% more income than needed for loan payments. Relevant experience in development or your industry sector is a huge plus, as is having the financial capacity to weather cost overruns.

Your project itself needs to tick several boxes: detailed construction plans, a realistic budget with built-in contingencies, all necessary permits, and a qualified general contractor with a proven track record. For speculative projects, lenders will want to see a feasibility study or market analysis showing demand for your proposed development.

The documentation package is substantial but straightforward. You’ll need the loan application itself, along with an executive summary of your project. Detailed construction plans, itemized budgets, and your timeline with clear milestones are essential. Your general contractor’s resume and references, construction contract (preferably in AIA format), environmental reports, property survey, and title information round out the property-specific requirements.

On the financial side, prepare to provide personal and business financial statements, three years of tax returns, and a business plan or proforma showing projected income for the completed project. If you’ve secured pre-leasing or pre-sales, documentation of these agreements will significantly strengthen your application.

At Top Remodeling Construction, we’ve helped numerous Las Vegas clients organize these materials efficiently. Proper preparation dramatically increases approval chances and speeds up the process.

Boosting Approval Odds for Commercial Construction Financing

Want to improve your chances of securing favorable commercial construction financing? After years in the business, we’ve identified several strategies that consistently help our clients succeed.

First, partner with an experienced general contractor who has a strong track record. Lenders evaluate your contractor almost as carefully as they evaluate you – they want assurance that your project will be completed professionally, on time, and within budget.

Consider contributing more equity than the minimum requirement. A larger down payment demonstrates your commitment and reduces the lender’s risk exposure – often resulting in better terms and easier approval.

Pre-leases or pre-sales can be game-changers, especially for commercial or multi-unit residential projects. When you can show that 30-50% of your space is already committed to paying tenants or buyers, lenders gain confidence in your project’s viability.

Don’t overlook SBA guarantees, which can make your loan application more attractive to lenders by reducing their risk. Similarly, research tax credits or incentives specific to your project type or location – these can significantly improve your financial projections.

Develop detailed contingency plans that address potential challenges. Lenders want to see that you’ve thought through possible issues and have strategies to mitigate them. Demonstrating relevant experience in similar projects (or partnering with those who have it) further strengthens your case.

Maintaining excellent personal and business credit scores above 700 if possible, preparing a professional, comprehensive loan package, and considering working with a loan broker who specializes in commercial construction financing are all strategies that can help tip the scales in your favor.

For a free quote on your commercial construction project and personalized guidance on financing options that might work best for your situation, visit our Free Quote page. We’re happy to help you steer this complex but rewarding process.

Risk Management, Cash Flow, and Alternatives

Managing risk is a critical component of successful commercial construction financing. Both lenders and borrowers must implement strategies to mitigate the various risks inherent in construction projects.

Managing Cash Flow During Commercial Construction Financing

Cash flow management is perhaps the most challenging aspect of construction projects. When you’re dealing with a draw schedule rather than upfront funding, you’ll need to plan carefully to keep operations running smoothly.

One of the most helpful tools in your cash flow arsenal is an interest reserve. By including this in your loan amount, you can cover those interest payments during construction without reaching into your own pocket before the property starts making money. Think of it as a built-in safety net for your finances.

Aligning your draw schedule with your actual cash needs is absolutely crucial. I’ve seen many clients face unnecessary stress when they have to pay subcontractors before receiving their loan disbursement. At Top Remodeling Construction, we work closely with lenders to create realistic schedules that won’t leave you in a financial pinch.

Progress billing with your contractors and suppliers can be a lifesaver. When these payment schedules match your draw schedule, you’ll minimize those uncomfortable gaps between when you pay out and when you get reimbursed. It’s like choreographing a financial dance where everyone moves in harmony.

“I always tell our Las Vegas clients to create weekly cash flow projections,” says our financial advisor. “It might seem like extra work, but those regular updates give you the power to spot potential shortfalls before they turn into emergencies.”

Don’t forget about retainage – that 5-10% held back from each payment. While it protects the project, it can also create cash flow challenges if you’re not prepared. Build this into your projections from day one.

Common Pitfalls & How to Avoid Them

Even experienced developers can stumble into common construction financing pitfalls. Let’s look at how to sidestep the most troublesome ones.

Underbudgeting can derail even the most promising project. We always recommend including at least a 10% contingency buffer. Construction has too many variables to cut it close – from material price fluctuations to unexpected site conditions. One Las Vegas client saved their project when concrete prices suddenly spiked, simply because they had built in that buffer.

Change orders are notorious budget-busters. While design changes are sometimes unavoidable, thorough planning before breaking ground can minimize them. When changes do become necessary, implement a formal process that analyzes cost impacts before proceeding. Your future self will thank you!

Draw process delays can create serious cash crunches. Understanding your lender’s inspection and disbursement processes beforehand is crucial. We’ve helped many clients prepare documentation well in advance and establish open communication channels with their lenders to keep funds flowing smoothly.

Permitting and compliance issues can stop a project in its tracks. Research requirements thoroughly and consider working with professionals who have steerd the local regulatory landscape successfully. In Las Vegas, building codes and requirements change frequently, so local expertise is invaluable.

The nightmare scenario of contractor or supplier defaults can be mitigated through thorough vetting, requiring performance bonds, and having backup plans for critical path items. When a drywall contractor suddenly went out of business mid-project, one of our clients was able to quickly engage a backup firm we had already identified.

Lien claims can disrupt funding and create legal headaches. Collecting lien waivers with each payment and maintaining clear payment documentation creates a paper trail that protects everyone involved.

Don’t underestimate the impact of weather and force majeure delays. In Las Vegas, summer heat can limit certain construction activities, while occasional flash floods can cause unexpected delays. Building realistic schedules that account for seasonal factors can help keep your project and financing on track.

Inadequate monitoring is a silent project killer. Weekly progress meetings and detailed reporting systems allow for early intervention when issues arise. At Top Remodeling Construction, we believe that problems spotted early are problems solved affordably.

Exit Strategies: Permanent Debt & Refinance Options

Your exit strategy from commercial construction financing should be planned before you even apply for the loan. Think of it as planning your destination before starting the journey.

If your loan includes a construction-to-permanent conversion feature, you’ll need to meet specific stabilization criteria for that automatic transition to occur. This typically includes obtaining a certificate of occupancy, achieving minimum occupancy levels (usually 70-80%), meeting debt service coverage ratio requirements (typically 1.25 or higher), and completing all construction according to approved plans.

For construction loans without automatic conversion, you’ll need to arrange permanent financing refinance. Start this process 3-6 months before your construction loan matures to avoid any financing gaps. Consider rate-lock options to protect against interest rate increases, especially in today’s volatile market. One client saved thousands by locking in their rate three months before completing their retail development.

If you’re planning a property sale as your exit strategy, ensure marketing begins well before construction completion. Understanding buyer financing requirements can help you position the property appropriately. Consider pre-sale agreements to reduce risk, but always have backup refinance options if sales don’t materialize as expected.

“The transition from construction to permanent financing is a critical juncture,” shares our financing specialist. “In Las Vegas’s dynamic market, we recommend clients maintain relationships with multiple potential permanent lenders throughout the construction process to ensure competitive options when the time comes.”

At Top Remodeling Construction, we’ve guided numerous clients through this complex transition, helping them secure favorable long-term financing that complements their business goals and property performance.

Conclusion & Next Steps

Navigating commercial construction financing is a bit like planning a road trip through unfamiliar territory. You need a good map, reliable transportation, and some contingency plans for when things don’t go exactly as expected. With the right preparation, though, your construction project can proceed smoothly from groundbreaking to ribbon-cutting.

We’ve seen at Top Remodeling Construction how proper financing can make or break a commercial project. Our years working in the Las Vegas market have taught us that local knowledge matters – from permitting quirks to seasonal construction considerations that affect your timeline and budget.

Ready to move forward with your commercial project? Here’s your roadmap:

Start by developing a comprehensive project plan with detailed designs and specifications. This isn’t just for the construction team – lenders will want to see exactly what they’re financing. Be thorough here; vague plans lead to budget overruns.

Create a realistic timeline that accounts for the full project lifecycle. Remember to build in buffer time for permits (which always seem to take longer than expected) and potential weather delays, especially important in Las Vegas’s summer heat.

Research potential lenders who specialize in your project type. Not all lenders are created equal – some excel with retail spaces while others prefer industrial projects. Make a shortlist of those who understand your vision.

Prepare your documentation package well before approaching lenders. Having your business financials, personal financial statements, project plans, and contractor information organized shows you’re serious and prepared. Lenders love borrowers who make their job easier!

Establish where your equity contribution will come from and ensure those funds are readily available. Nothing derails financing faster than a borrower who can’t produce their portion of the project costs when needed.

Build in adequate contingency reserves – both in budget (at least 10%) and schedule. In construction, surprises happen. The difference between successful projects and stressful ones often comes down to having these buffers in place.

Consult with trusted financial and legal advisors to optimize your financing structure. Their expertise can often save you significant money over the life of your loan through favorable terms or tax advantages.

Consider engaging an experienced construction manager who understands how to maintain lender compliance throughout the project. They’ll help ensure draw requests proceed smoothly and keep your project on track financially.

Commercial construction financing isn’t one-size-fits-all. Your optimal structure depends on your specific project, financial situation, and long-term goals. A retail space with pre-signed tenants will qualify for different terms than a speculative office building, for instance.

At Top Remodeling Construction, we’ve guided many clients through this process. We understand that financing might not be the most exciting part of your project, but it’s certainly one of the most important. Our team is committed to helping you steer these waters, combining quality craftsmanship with practical financial guidance.

For more information about our commercial construction services and how we can help you with financing, visit our services page or reach out for a personalized consultation. We’d love to help turn your commercial construction vision into reality – from blueprints to grand opening.